How to choose trading strategies and become a successful investor

Choosing trading strategies for copying is the most important step, which your further performance depends on. One improperly chosen trading strategy can affect the total return of your entire portfolio made up of perspective strategies.

Tips for becoming a successful investor

There is no fast and easy money

Realize that there is no fast and easy money in the long-term. Investments represent a long-term process. The minimum period required to evaluate the return on investments must not be less than 3 months.

Choose strategies from TOP 10

You should choose strategies listed in the TOP 10 (or TOP 20) of our main rating or PRO category. Our algorithm used to calculate the rating is designed in such a way that the most perspective trading strategies are promoted to the top positions. Return on a strategy is not the main criterion.

Prolonged trading history

Most of the strategies end in failure during the first 3 to 8 months. This is why you should choose the strategies that have trading histories longer than 1 year. As a rule, they are more reliable.

2-10% monthly return

Don’t take strategies showing huge returns seriously. Such strategies are usually very risky and lead to losses sooner or later. The strategy with a prolonged history of trades and an average monthly return of 2-10% is considered to be a good investment. If your capital doesn’t exceed $50 000, treat your investments as an additional source of passive income, but not a primary source of income.

2 to 5 strategies are enough

It doesn’t make any sense to add as many strategies to your portfolio as possible. Usually, it’s enough to add 2-5 strategies. If you add more strategies, it will increase diversification on the one hand and dilute the total return of your portfolio on the other hand.

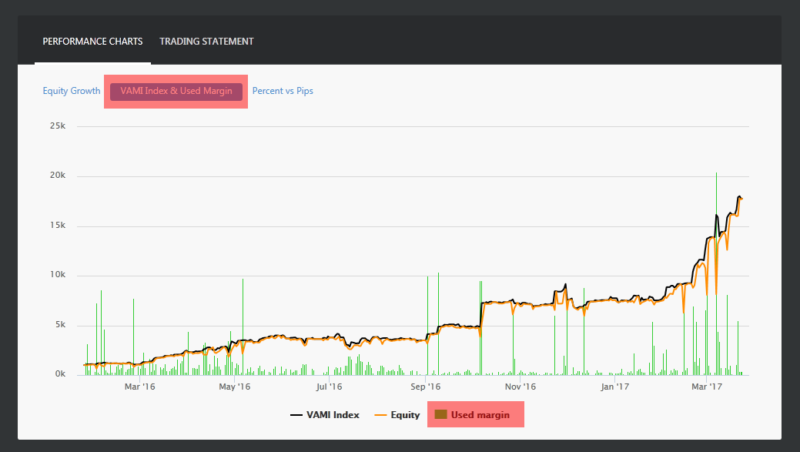

The smaller the leverage, the less the risk

Try to choose the strategies that use a smaller amount of margin (leverage). The smaller is the used leverage, the less is the potential risk, and vice versa. You can assure of it by the Used Margin chart. It is recommended to choose the strategies that use up to 10% of margin on average (or a leverage of up to 1:10).

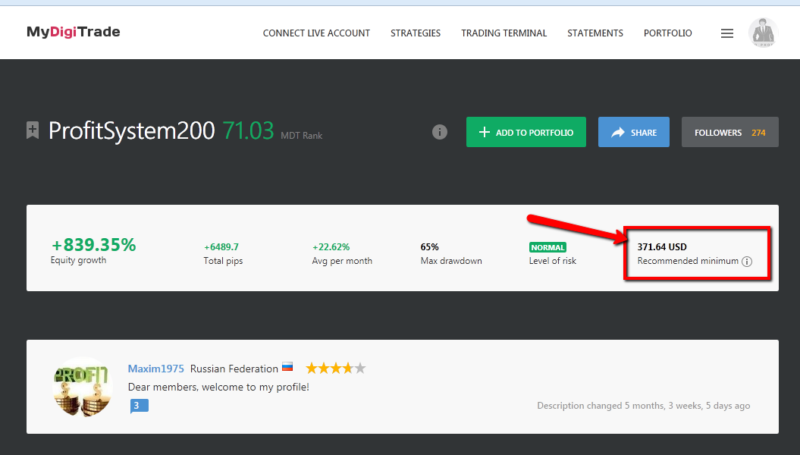

Recommended minimum

Follow recommendations concerning keeping to the minimum account balance when choosing one or another strategy. It will allow you to avoid forced closure of your positions by a broker in case of a drawdown in your investment portfolio.

Automatic settings adjustment

Select the “Automatic settings adjustment” option in your portfolio settings to start copying trades, if you’re not sure that you can customize the settings properly by yourself. Our system will automatically and evenly distribute your account balance among all the strategies included in your portfolio.

Define clear criterion of disconnection from a strategy

For example, set a condition for yourself: “If a strategy hits 20-30% drawdown, I will disconnect from it.” It must be the only criterion, based on which you will disconnect from a strategy without taking emotional decisions.

It often happens that a strategy yields small losses for several months in a row (-10% for the first month, and -5% for the second month). In such cases you start feeling that the strategy cannot yield profits anymore, so you lose interest in copying it. You take an emotional decision to disconnect from the strategy, which after a while earns +20% in the first month, +15% in the following month, etc.

Start thinking as a true investor!

Learn how to behave yourself not to stand out from the majority of beginners

(or things you mustn’t do)

- Charge yourself with a hope of making fast money. Perhaps, you will earn your first $1 million very soon.

- Choose the strategies that show maximum returns and add as many of these strategies to your portfolio as possible.

- Load your portfolio to the maximum and according to your inner feelings. Don’t comply with the recommendations concerning the minimum deposit, since they were devised to prompt people to deposit more funds.

- Choose the strategies that use the maximum leverage so that your deposit will be loaded fully.

- Connect to new strategies as soon as they appear in order to assess them on your real-money account and not miss your future profits.

- Disconnect from a strategy, when the first series of losing trades is made based on it. This kind of strategy has no chances to success, since a trader allows himself or herself making losing trades.

- Try to increase the working lot size immediately after a series of winning trades: it will allow your profits to grow faster on your account.

- Change your portfolio settings more often. The chief point is to be always involved in the process and perform more experiments!

- Try to interfere with a trader’s strategy in every way and help him or her close trades at the right moment.

- Open trades by yourself more often. An average volume of your trades (lot size) must be scores of times larger than that used by strategy providers.

Should you have any questions, please ask them in the comments below the article.

English

English Русский

Русский

No comments